Sloatsburgers have something to be thankful for this holiday season — a budget gift from the Village Board.

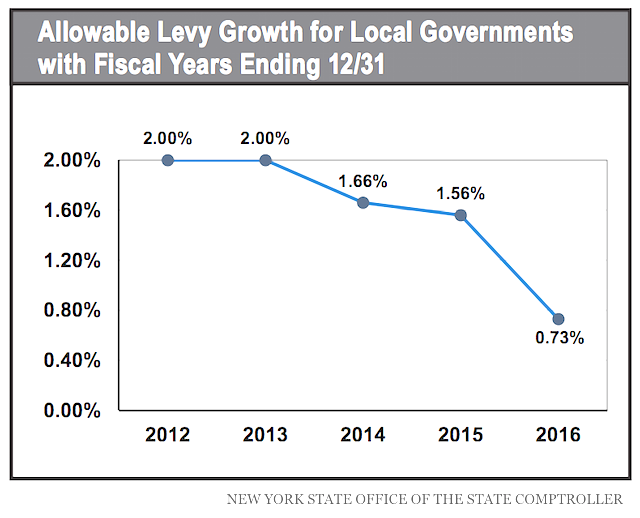

The board passed the 2016 budget of approximately $2.8 million dollars in mid-November, with a slight overall year-to-year increase of $56,000. That means the local tax rate increased .7, which comes just under the 2016 razor thin .73 NY State Tax Cap. Residents will again qualify for the NY State property tax credit that’s tied to the tax cap.

The board passed the 2016 budget of approximately $2.8 million dollars in mid-November, with a slight overall year-to-year increase of $56,000. That means the local tax rate increased .7, which comes just under the 2016 razor thin .73 NY State Tax Cap. Residents will again qualify for the NY State property tax credit that’s tied to the tax cap.

The NY tax cap downward pressure has been effective in tamping down increases in local taxes, with some municipalities and school districts facing zero growth budgets.

So far Sloatsburg has been able to retain valuable municipal services without breaking the bank.

Compare Sloatsburg to the Village of Airmont, which, according to the Rockland County Times, just announced an 8.5% tax increase, with a total village budget of some $3.32 million dollars.

Compare Sloatsburg to the Village of Airmont, which, according to the Rockland County Times, just announced an 8.5% tax increase, with a total village budget of some $3.32 million dollars.

Airmont Mayor Philip Gigante said the village tax increase was mostly due to infrastructure investment, with $400,000 earmarked for road improvements and another $50,000 for drainage.

Sloatsburg has played the long game in terms of road repair and voter risk/reward, with Village Hall taking heat over the years for deteriorating village roads while waiting for the Western Ramapo Sewer District project to kick in.

With the Western Ramapo Sewer Project construction progressing throughout the village, residents have had to endure poor road conditions. But as construction has finished in stages throughout village neighborhoods, Sloatsburg has also slowly been repaved, at a fraction of the cost it may have taken the municipality to cover the road improvements outright.

The Village also added $125,000 of debt via bond anticipation notes for a municipal vehicle and equipment purchases, that also covered associated costs for the major Pine Grove Lakes drainage improvement project ( paving included) — all worked so that the village took on bond debt without raising tax rates above the NY tax cap.

To date, the mantra of the Village Board of Trustees has been “keep it under the tax cap.”

General Sloatsburg government support (Village Hall) was the biggest ticket item, with Transportation a top expense that includes the Department of Public Works, snow removal, street lighting, and other contracted expenses. Public Safety, including the Sloatsburg Volunteer Fire Department, came in at a bargain. That bill includes fire hydrant costs to Suez NY, formerly known as your beloved United Water, which take up a good chunk. Each fire hydrant costs the Village approximately $800 per year.

With rising material costs of doing business (and ever shifting commercial and residential tax income), Sloatsburg could very well visit the costs vs services equation other municipalities have been dealing with.

For now, give a round of applause to the Village Board and Village Clerk for making the numbers work.